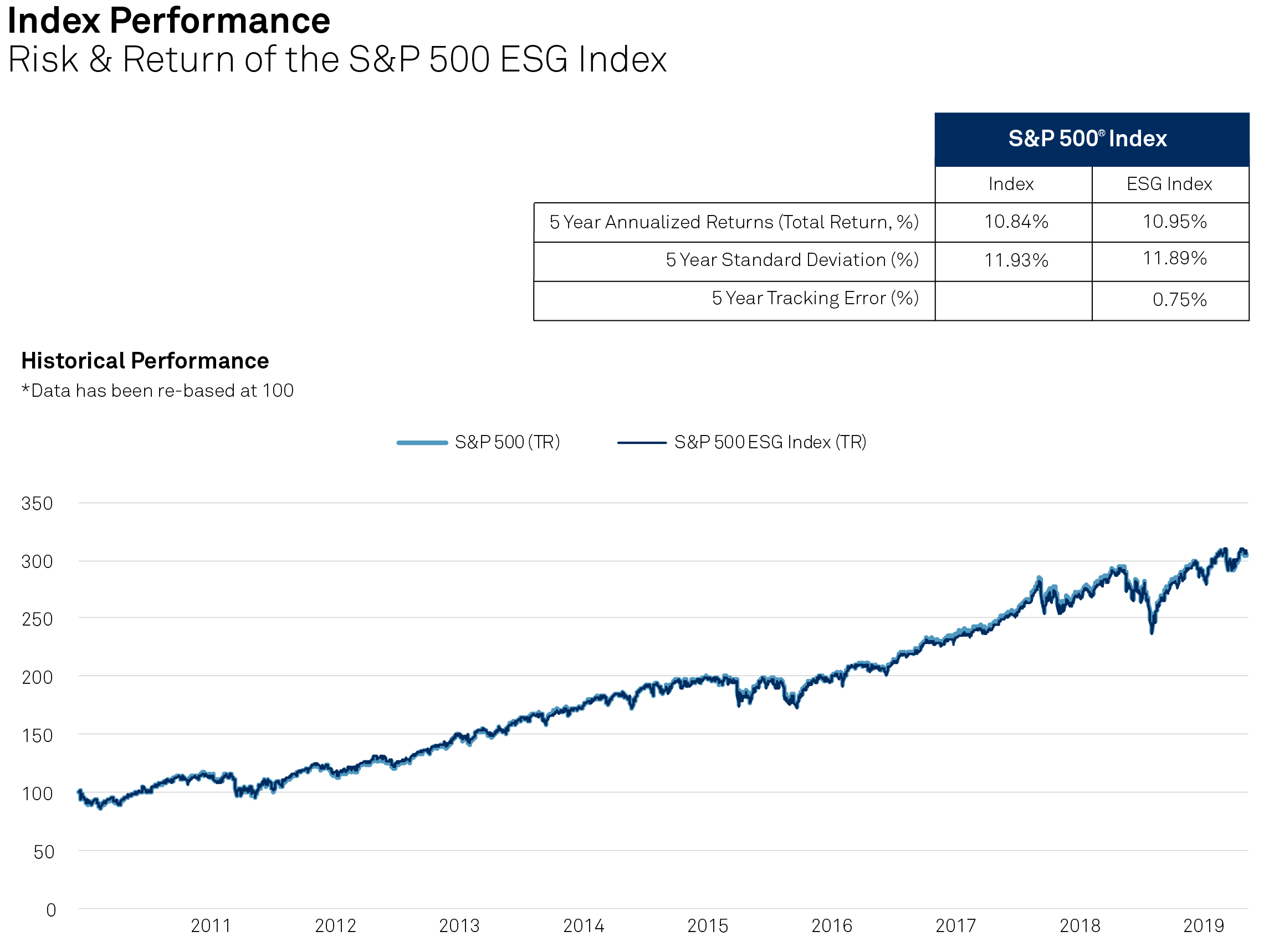

These indexes are tracked to measure changes over time. Economic indexes closely followed in the financial markets include the Purchasing Managers' Index (PMI), the Institute for Supply Management’s Manufacturing Index (ISM), and the Composite Index of Leading Economic Indicators. Indexes created by economists provide some of the market’s leading indicators for economic trends. Its slope indicates the strength of the trend. In theory, the direction of the moving average (higher, lower or flat) indicates the trend of the market. The metric combines a task's index of difficulty ( ID) with the movement time ( MT, in seconds) in selecting the target. For the major indices on the site, this widget shows the percentage of stocks contained in the index that are above their 20-Day, 50-Day, 100-Day, 150-Day, and 200-Day Moving Averages.

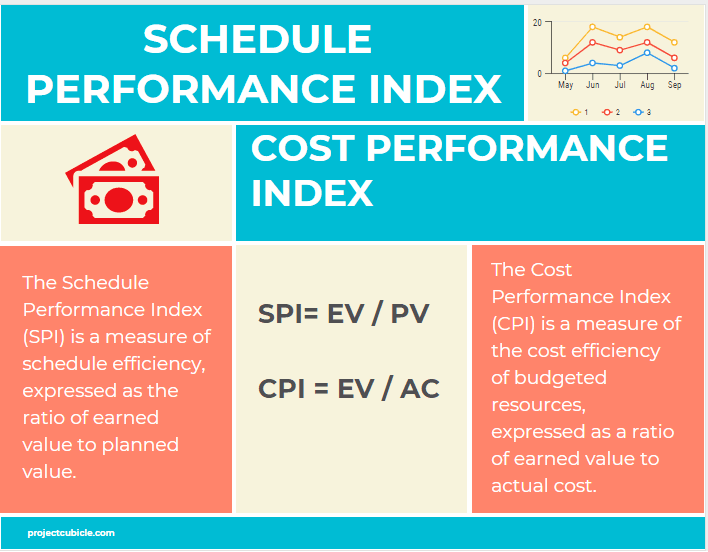

Indexing is used in the financial market as a statistical measure for tracking economic data. Fitts also proposed an index of performance ( IP, in bits per second) as a measure of human performance.

There are many indexes in finance that reflect on economic activity or summarize market activity. Key performance indicators (KPIs) refer to a set of quantifiable measurements used to gauge a company’s overall long-term performance.Indexing is the practice of compiling economic data into a single metric or comparing data to such a metric.

0 kommentar(er)

0 kommentar(er)